SSS Loans: How to Apply SSS Loan Online

SSS Loans: SSS Multi Purpose Loan:- Are you looking for financial solutions that meet your needs? SSS Multi-Purpose Loans: Find out what they are all about! Become financially independent with our convenience, affordable prices, and adjustable terms.

An employee or self-employed or voluntary member can apply for a cash loan. The loan is intended to meet the member’s short-term credit needs. Click here for more information

SSS Multipurpose Loan Requirements

Getting to Know SSS Multipurpose Loans

To unlock financial flexibility, you must understand SSS Multi-Purpose Loans. There are a variety of uses for these flexible and easy-to-use loans, including home renovations, unexpected bills, and schooling. Every Filipino can now borrow thanks to SSS, ensuring their financial security.

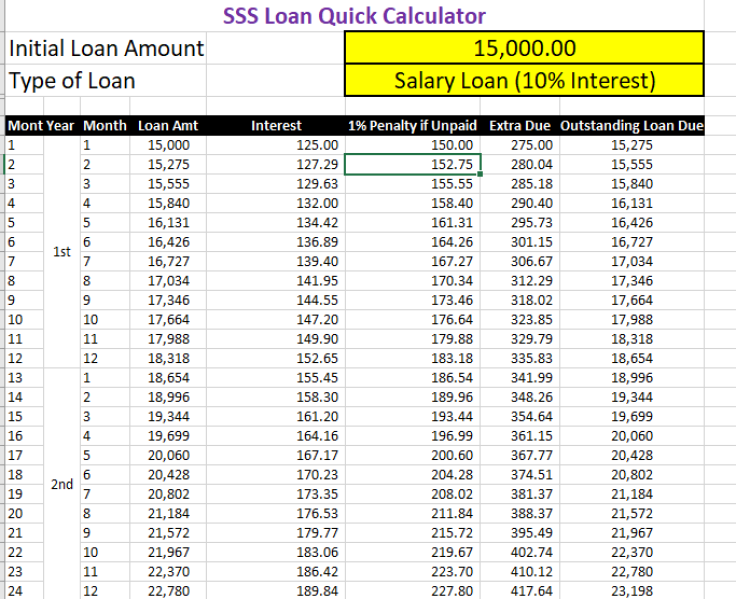

SSS Multi Purpose Loan Interest

There shall be a 10% annual interest rate until the loan is fully repaid, computed on the diminishing principal balance, and amortized over 24 months.

SSS Multipurpose Loans: Advantages

| Speedy Access | Quick approval procedures and less paperwork save you time and hassle. |

| Reasonably Priced | With their attractive interest rates, SSS Multi-Purpose Loans are reasonably priced without sacrificing quality. |

| Flexible Terms | Choose a repayment plan that fits your financial situation to ensure ease and peace of mind. |

Who is Eligible for SSS Loan

All employees, self-employed members, and voluntary members. In order to qualify for a one-month loan, the member-borrower must have thirty six (36) monthly contributions, six (6) of which must have been made within the last twelve (12) months.

How is the First Loan In SSS

In order to qualify for the salary loan, you must have completed at least 36 months of total contributions, including six (6) months posted in the last 12 months (before the month of application).

SSS Multi Purpose Loan Calculator

The average of a member-borrower’s 12 most recent Monthly Salary Credits (MSCs), rounded to the next higher MSC, or the amount applied for, whichever is lower, constitutes a one-month salary loan.

Contact Detail Of SSS Multipurpose Loan

The SSS website can be accessed at www.sss.gov.ph or you can contact our Call Center at 920-6446 up to 55 or 917-7777 for verification of your status. UPON APPROVAL OF THE MEMBER LOAN APPLICATION, SSS WILL ISSUED A DISCLOSURE STATEMENT TO THE MEMBER-BORROWER.

FAQs About SSS Loans

Conclusion

SSS Multi-Purpose Loans provide financial solutions with quick approval, affordable interest rates, and flexible terms. Perfect for home renovations, unexpected bills, and education, these loans offer every Filipino a reliable way to ensure financial security and independence.